GameStop, TikTok and the future of markets; 2016 election fraud

What does the GameStop phenomenon mean? New 2016 election fraud charges; Proud Boys leader an Informant

Welcome to the second issue of the Hat Tip!

In this issue

The Big News: Election Fraud charges for… 2016?

Considering: WallStreetBets, GameStop and the Scribe Problem

Curious: Proud boys leader is an FBI Informant?

Worth Reading: AstraZeneca CEO on the Vaccine Wars

The Big(ish) News: Election Fraud charges for… 2016?

The US Department of Justice today unsealed charges against Douglass Mackey, who was known online as Ricky Vaughn, for voter suppression in the 2016 election.

Vaughn, an antisemitic white nationalist, was a major pro-Trump influencer during the 2016 election. This Buzzfeed article gives a good rundown. Vaughn pushed PizzaGate, racist memes and general alt-Right content.

According to the Complaint, Vaughn aka Mackey conspired with other alt-Right influencers to create fake content to target African-Americans and Latinos, falsely claiming they could vote for Hillary Clinton by SMS and avoid the lines. Nearly 5000 people tried to use this service and may have ended up not voting.

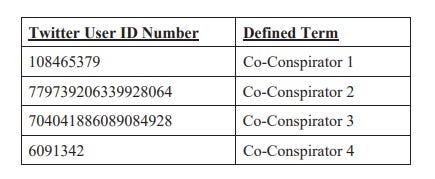

The Complaint lists four co-conspirators. It doesn’t name them but gives their Twitter IDs.

It took @AntifascistF12 on Twitter no time to work out who the co-conspirators are:

Baked Alaska

Microchip

Nia4Trump

1080p

Yup, that’s Baked Alaska, aka Tim Gionet, a popular alt-right streamer who was also arrested for his part in the Capitol Riot. Small world!

Two points of interest:

Vaughn continued to publicly defend a fake Tennessee GOP Twitter account, TEN_GOP, even after it was revealed to be run by Russia as part of an attempt to, yup, influence the 2016 election

It’s certainly curious that this charge was revealed now. Was DoJ sitting on it until Trump was out of office?

Considering: WallStreetBets, GameStop and the Scribe Problem

I’ve been on Reddit since 2012, and have 60k Reddit karma (under the new system, at least). So I’m familiar with Reddit and its overall culture. However, each subreddit has its own unique rules, users and conventions, and I’m not a /r/WallStreetBets regular. The subreddit has been growing a lot this last year, such that it’s been referenced in posts and memes on other subs and the frontpage. At time of writing, it had 2,797,545 subscribers; of these, a massive 348,747 were looking at it right that minute.

WallStreetBets is basically a forum for stock traders, from people with a few hundred dollars to play with up to bigger investors messing around with millions, from genuine novices through to people with spreadsheets coming out of their ears who have a deep understanding of the markets. All of these people talk, share ideas, ask questions, give advice and stock tips. WSB is large enough that it can move share prices on its own.

GameStop is a videogame store chain. As you might expect, they aren’t doing well; these days, more people buy games from online retailers or even download them from online stores like Steam or Epic. Throw in a global pandemic that’s shut shops in many cities for months at a time, and their business is in bad shape.

WallStreetBets likes GameStop, probably partly for nostalgic reasons; a lot of Millennials and Zoomers have fond memories of browsing, saving, the excitement of leaving the shop with a new game.

In August, a post on WSB titled “Bankrupting Institutional Investors for Dummies, ft GameStop”, argued that the stock was undervalued. It noted that the next generation of gaming consoles was about to be released, pushing games sales up. It also pointed to investments by Ryan Cohen and Michael ‘the big Short’ Burry, and noted that there were a lot of short positions against GameStop by investors who were gambling against the company. The post noted that the share price was around $10, and predicted:

When the stock hits roughly $15, we can expect to see several margin calls trigger a fucking massive short squeeze

as short sellers would rush to buy stocks in order to cover their positions.

The idea was popular enough that many WSB users put money into GameStop stock, though many also remained sceptical

But then they found an enemy. Melvin Capital was reportedly responsible for a lot of the short positions against GameStop. Suddenly, it wasn’t just about making some money; it was also about taking down that most hated of creatures, a short-selling globalist elite hedge fund. More Reddit investors piled in, some with $600 stimulus cheques to spend. The subreddit grew. Some were motivated by sticking it to The Man and taking down Wall Street. Some wanted to get rich. Some were just along for the ride.

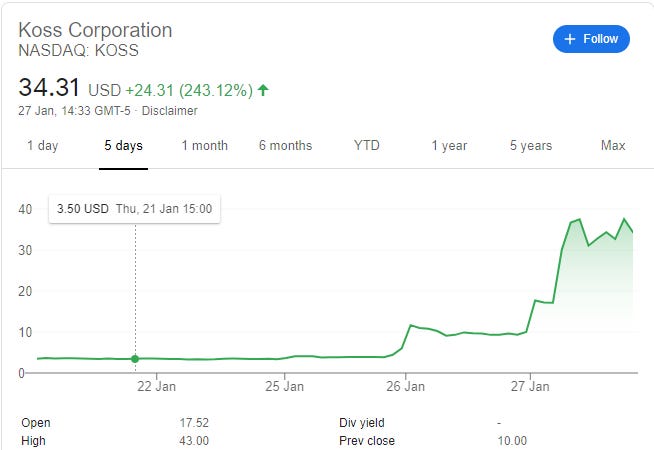

To my un-expert eye, it looks like the beginnings of a short squeeze happened closer to $20, on 12 January. But then it really became a thing.

Over the last few days it’s all gone a bit nuts. GameStop’s stock price kept rising. Redditors claimed Melvin was manipulating the market in an attempt to crash the stock and keep their losses low, but if that really happened, it failed.

When Andrew Left from Citron Research, who’s also short on GameStop, tried to explain why he thought the price would crash, he was targeted by harassment in an attempt to shut him down. Was this ideological Redditors out to smash a hedge fund? Or Reddit investors seeking to protect their investment? But then maybe Left was also trying to push the price back to where he thought it should be, too.

And now it’s jumped up another level, after Melvin was forced to raise additional funding to keep afloat and Elon Musk tweeted in support of GameStop stock. Some WallStreetBets users are blocking their shares from being used to cover the short, in the hope that this will force up the price further when the short sellers have to cover their positions. Melvin told the media that it had closed its short positions on GameStop this morning, but WallStreetBets doesn’t believe them. Oh, and now the TikTokkers are involved too.

GameStop was $10 a share in September. It closed last night at $148. It opened this morning at $355.

Of course, Reddit is just the tip of the spear. Institutional investors are following the trend and adding to the volume too, now.

This is my layman’s narrative. Matt Levine at Bloomberg explains it better, with a lot more technical detail.

What does it all mean?

Melvin made a big, naked bet that GameStop would fail, and it looks like they’d have lost that bet anyway. Now they’re going to lose much worse, but nobody’s sad when a hedge fund loses.

Some of the WallStreetBets users are hoping that not only will Melvin fail, but that it will bring down Melvin’s backers and lead to wider contagion. I’m not in any position to assess how likely that is, though I haven’t seen any serious people worried about it.

A few things do worry me, though:

What happens when the music stops?

The people who got into GameStop early are doing fine. Reddit has a lot of new millionaires and plenty of people who turned a few hundred bucks into several thousand. Good for them. The people dashing in today, though are taking a big risk. WallStreetBets says they’re trying to drive the stock to $1000 a share, and maybe they’ll succeed. None of these people believe GameStop is actually worth the sky-high valuation they’re investing at. Everyone is being told to hold, usually with 🚀🚀🚀rocket emojis. But gravity always wins, and some ‘innocent’ investors are going to lose their shirts too.

GameStop won’t be the last one of these

The power of crowdsourced day-traders to move markets could be enormous, creating massive market-distorting bubbles. Already, several other companies with short positions are being targeted, like headphone company Koss.

Perhaps WallStreetBets will chase the short sellers out of town for good. But there will always be another stock to pump and a righteous reason to pump it. Just like any other large community, actors on WSB are motivated by different reasons; some are ideological, some are in it for the cash; some will try to maximize value for the community, and others will try to pump and dump even if others get hurt.

Social Media algorithms meet investments

A lot has been written about how social media algorithms drive people to content via their recommendations. One insightful piece noted that these same algorithms were pushing GameStop stock content onto TikTokkers, helping to create not just a herd mentality but the herd itself. And people who interacted with the GameStop content will be more likely to see stuff about whatever stock is next. Social media, then, can create and snowball market effects.

The Scribe problem

In Clay Shirky’s book Here Comes Everybody, he writes about how certain professions used to be tightly-guarded guilds that eventually disappeared as their core skills became widely available. His example is scribes. Once, a scribe as a highly-specialised job. Literacy was low, and scribal skills were rare. As more people were able to write, and then the printing press made a lot of scribal work irrelevant. Despite this, there was a period when certain tasks still needed a scribe, because that was the rule. There was a period of nostalgia for scribes, too.

A lot of jobs have gone through the scribe cycle. 25 years ago, offices had huge “typing pools” of people, mostly women, typing up dictations or scrawled notes. Now there are barely any typists; every office worker is expected to do his or her share of typing.

Shirky cites journalism as another profession where the lines are blurred now, and this was clear at the Capitol riot; so many of the insurrectionists were live-streaming themselves, and how the distinction between ‘reporter for a Trumpist media outlet’ and ‘rioter’ was thin at best.

Now perhaps it’s the stockbroker’s turn. With trading apps like RobinHood making it easy for anyone to play the markets, the trading floor is really open to all. Crowd effects will be bigger, individual stocks will be more volatile and swings more dramatic. Maybe we’ll have to get used to a random stock exploding in value for no obvious reason.

The bubble

We’re in the middle of the worst global pandemic in a century which hit before we’d fully unwound the global financial crisis of 2007. Countries have had negligible or negative interest rates to fuel growth while maintaining huge national debts, running enormous budget deficits. And the markets have been booming, reaching record highs.

Venture Capitalists are throwing millions of bucks at any two guys with a Powerpoint presentation, hoping theirs will be the next big thing. Valuations are wild.

Is any of this really sustainable? Is what WallStreetBets is doing just a reflection of the wildness of this long bull market? And could it ultimately be the last gasp before markets as a whole take a deep breath?

I don’t know. But then I don’t even know how and when this GameStop stuff will end, either.

(Full disclosure: I own some stock, but not in any company mentioned in this newsletter)

Curious: Proud boys leader is an FBI Informant?

Enrique Tarrio, the leader of the Proud Boys extremist pseudo-militia group, was arrested before the Capitol riot when he landed in DC. He was already wanted for a hate crime, ripping a Black Lives Matter banner off of a church, and he was also charged with firearms offenses.

Now, it’s emerged that Tarrio was a long-time informant for federal and state law enforcement who had “helped authorities prosecute more than a dozen people in various cases involving drugs, gambling and human smuggling”.

Tarrio, when asked by Reuters, claimed not to remember anything about it! But it did make a lot of people wonder about his convenient arrest before the Capitol riot.

Worth Reading

If you’re interested in the Vaccine Wars in Europe, this interview with AstraZeneca CEO Pascal Soriot is worth your time.

Now we have a vaccine and everybody thinks it's easy. But in April last year, everybody was saying “it's impossible to do a vaccine by the end of the 2020”, or “you're going too fast” or “you're cutting corners”, “you can't do it”, eccetera. Now everybody is saying “you’re too slow”, while before we were “too fast”.

Thanks for reading! Feedback is always appreciated.

-Arieh